HELB loans are available for self-sponsored students in Kenya, but it’s not as simple as it sounds. There is one limitation that will make you frown a little.

But before we get there, let’s set the stage with a brief introduction to HELB because I’m pretty sure you wouldn’t have stumbled here if you weren’t curious about it.

HELB (Higher Education Loans Board) awards loans to students who join public and private universities in Kenya at an annual interest of 4%. These loans provide financial relief to students who find it hard to finance their tertiary education.

Which reminds me, HELB loans can help elevate financial burden while studying but be aware interest accumulates and once you graduate you will need to start paying your loans because employers will require a HELB clearance certificate before they can even interview you.

Originally, these loans were meant for government-sponsored students admitted through Joint Admission Board which transitioned to KUCCPS. However, the government extended the service to provide loans for self-sponsored students in Kenya.

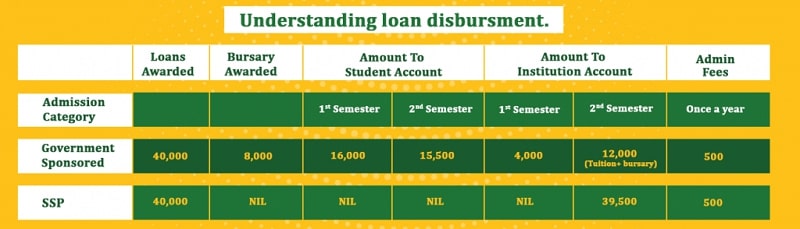

Self-sponsored students are therefore eligible to apply for these loans which range from a minimum of Ksh 40,000 to a maximum of Ksh 60,000.

So what limitation was I talking about?

While government-sponsored students get about 90% of the loans awarded deposited in their bank accounts and a standard Ksh 8000 remitted as school fees, self-sponsored students have all the cash paid as school fees once annually.

This doesn’t settle well with most comrades who wanted to enjoy the experience of getting HELB loans for personal use. However, considering that most university students never make good use of their loans, this system seems to work in favor of the self-sponsored students over the long run.

An administrative fee of Ksh 500 per year is usually deducted from your disbursed loan.

Meanwhile, bursaries only apply to needy government-sponsored students; SSP students are not eligible to apply.

How Self-Sponsored students apply for HELB loans.

The process is the same for all but before you begin, ensure you meet these two conditions

- You have been placed by the KUCCPS (Kenya Universities and Colleges Placement Service) in the local and private universities

- You are studying for a Bachelor’s Degree.

Why did they lock out pre-university, certificate, diploma and postgraduate students? Seems like they only empower dreams from a select few.

Application process

- Visit HELB student portal at portal.helb.co.ke

- Register to create an account.

- Log in and select Undergraduate First Time Loan Application Form

- Fill the loan application form

- Print 2 copies of the filled form

- Have the forms filled, signed and stamped by the relevant authorities

- Sign to accept the Loan terms and conditions

Present one copy of the completed forms attached with all supporting documents at any Huduma center in the country or HELB headquarters (Anniversary Towers in Nairobi). Retain the other copy

Honestly, I think it’s much safer to personally deposit the filled copy at Anniversary Towers, or through a friend. Huduma Centers are functional but for a fact, they act as brokers in this case. Thus the document might get not get delivered in the main office and you will have a hard time tracing it.

The documents that must be attached with the filled form include

- Copy of National ID

- Copies of Parents National IDs or Death Certificated where the parent is deceased

- Copies of guarantor’s National IDs

- Copy of Applicant University Admission letter

- Copies of KCSE Result Slip and Certificate

- Copy of Applicant’s Smart Card from the institution if there is one.

- Recent colored passport size photo of the Applicant.

In case you are government-sponsored and you accidentally stumbled here, make sure you have a copy of Bank ATM Card too.

The sad truth is that not everybody is awarded the loan and evidently, a smaller percentage of SSP students get these loans as compared to their counterparts.

If you get lucky and are awarded, take note that the disbursement will be done only once a year at the start of the second semester and as earlier stated, all the cash will go to your school fees, which is why you don’t need a copy of Bank ATM card to apply.

You are advised to start the application early enough before the opening dates of an academic year to allow enough time for processing.

Thanks for the information and so,it means both upkeep and tution are paid to the university for a self sponsered student